Reducing the level of non-compliance in the R&D tax relief schemes is a priority for HMRC. With error and fraud at unacceptable levels, claims are being subjected to close scrutiny. Mistakes and discrepancies which may have previously slipped through the net are now being picked up, resulting in more businesses being subjected to the HMRC enquiry process.

Dealing with a HMRC enquiry is time-consuming for claimants. Enquiries can last for several months or much longer in more complex cases. They lead to payments being delayed and where claims are not successfully defended, they can be reduced or declined altogether. If HMRC suspect fraudulent activity they can ultimately issue a fine.

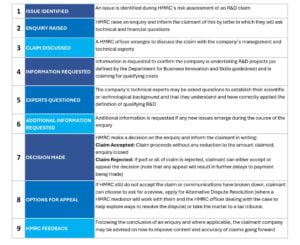

The HMRC Enquiry Process

Whilst there is no guaranteed method that will prevent an enquiry being raised, being aware of the most common pitfalls that lead to further questions can put you in a stronger position to avoid it.

If HMRC are unsure whether some or all of your projects qualify for R&D Tax Credits they will ask you to provide further evidence in support of your claim. In practice, this isn’t as straightforward as it sounds given the length of time their investigations can take and the volume of additional information they request. Below is an overview of the process:

Useful to Know

It’s crucial to note that if HMRC question the validity of a claim this doesn’t definitively mean the claim isn’t legitimate. HMRC do not always get it right and because those handling claims are not experts in science or technology there is often great scope for misunderstanding. If HMRC disagree with a claim there are various options for appeal and whilst this can be time-consuming, businesses need to be prepared to defend their claims to protect both the value of their claim and their reputation with HMRC.

Those inexperienced at claiming R&D Tax Credits often assume they have done something wrong and that they have to accept it if HMRC push back on their claim. This isn’t necessarily the case and it’s often worth seeking professional advice to help with a dispute if you are confident your claim is valid.

Where a payable R&D credit is withheld during an enquiry, HMRC keep under review the possibility of making interim payments as the enquiry progresses.

HMRC Enquiry Support

With a team of highly experienced technical specialists, R&D Funding Group has a wealth of experience in supporting businesses through a HMRC enquiry. Whether you want a second opinion to check your claim is robust prior to submission or you need full support with an enquiry, we can help. Further information can be found here.

Where R&D Funding Group has prepared your claim for R&D Tax Credits, full enquiry support is provided at no additional cost.